Keeping Your Cash Safe after the Silicon Valley Bank Collapse

Updated Mar 12 with the Federal Reserve update and Brex's updated FDIC-insured amount, $2.25M. Updated Mar 15 with Arc’s increased FDIC-insured amount. Updated May 1, 2023 with the removal of FRB. Updated July 1, 2024 after Evolve and Synpase scandals

I'm Aakash Shah, founder of Wyndly, where we're fixing allergies for life. We recently raised $2M, so I had to make a banking and cash management decision recently.

I manage multiple founder communities touching a wide variety of topics: Y Combinator, New York City, and digital health.

What should I do?

In short, to avoid catastrophes like Silicon Valley Bank collapse, Synapse collapse, or the Evolve Bank hack from affecting you, here’s what you should do:

Open a bank account with Arc (https://www.joinarc.com/). Explicitly ask them to custodian ALL of your cash at Goldman Sachs. Keep your cash here

Open a Capital One Spark Business 2% back credit card. Use credit card wherever you can, and pay out of your Arc account

Ok but who are you?

Here is a post from a founder in one of my communities:

I'm making this post to address the confusion around where founders should keep their cash after the collapse of Silicon Valley Bank.

Note: none of this is financial or legal advice. I will disclose affiliations where necessary, otherwise, I have no affiliation with anyone mentioned.

Contact me: email aakash AT aakash.io or DM me on Twitter or TikTok @aakashdotio.

Save your cash

“As always, your startup dies when you run out of money for whatever reason.”

Here’s what I’ve done at Wyndly, and what I suggest you do as a founder optimizing for your company.

- If you’re with a startup-focused neobank, double check for insured funds. (see below for increasing Brex insured and protected cash from the default $750k to $1.5M)

- Open an account at a “too big to fail” (TBTF) bank (see below for list)

- Make sure to use insured and protected sweep programs at both the neobank and the TBTF banks, when possible

- Choose safety over yield

Affiliation disclosure: Brex customer, Y Combinator founder

How and where to bank as a founder?

Work with banks or or cash management companies which:

Maximize insured funds with cash sweeps into FDIC insured and SIPC protected accounts

Have massive assets under management and low-risk banking partners and practices

You should have multiple banking relationships. I suggest:

A too big to fail bank

A cash management account neobank

Another, traditional bank with assets over $100 billion

Tip: When you’re trying to open many bank accounts, do yourself a favor and get all your organization articles in order.

-

FDIC insurance is a US government program that protects depositors in the United States if their bank fails. If your bank goes under, the FDIC will reimburse you up to $250,000 per account ownership category for each account you hold at that bank, including checking accounts, savings accounts, and CDs, but NOT including investment accounts. This helps give people peace of mind and confidence in the banking system.

-

The Securities Investor Protection Corporation (SIPC) protects customers if their brokerage firm fails. If this happens, the SIPC protects the securities and cash in your brokerage account up to $500,000. The $500,000 protection includes up to $250,000 protection for cash in your account to buy securities. Money market mutual funds, often thought of as cash, are protected as securities by SIPC, up to $500,000.

-

An FDIC cash sweep program at a bank is a type of sweep program that helps customers maximize their FDIC insurance coverage. The program automatically transfers funds between different deposit accounts to ensure that the total balance at the bank is always covered by FDIC insurance. For example, if a customer has $300,000 in deposits at a bank, $100,000 in a checking account and $200,000 in a savings account, the FDIC sweep program might automatically transfer $50,000 from the savings account to another bank where the funds will also be insured by the FDIC. This way, the customer's entire balance is protected by the FDIC in the event of a bank failure.

It is also common to see money market sweep programs, which move excess cash into a money market account.

Too Big To Fail Banking Options

The US government has decided the following institutions are systemically important to the financial health of the USA, also known as “too big to fail”. They are deemed Global Systemically Important Banks.

Generally speaking, these are the safest places to put your money.

I have not verified which of these offer business banking.

JP Morgan Chase

Bank of America

Citigroup

Goldman Sachs

Bank of New York Mellon

Morgan Stanley

State Street

Wells Fargo

US traditional banks with over $100 billion in assets

This is a list of banks headquartered in the USA with over $100 billion in assets which are subject to the most stringent Stress Test of the Federal Reserve. This is a signal that they are considered TBTF. The source is the Fed.

Bank of America Corporation

The Bank of New York Mellon Corporation

Citigroup Inc.

The Goldman Sachs Group, Inc.

JPMorgan Chase & Co.

Morgan Stanley

State Street Corporation

Wells Fargo & Company

Northern Trust Corporation

Capital One Financial Corporation

The Charles Schwab Corporation

The PNC Financial Services Group, Inc.

TD Group US Holdings LLC

Truist Financial Corporation

U.S. Bancorp

Startup Focused Cash Management and Banking Options

Brex

Mercury

Rho

Arc

These companies offer services catering to startups. They do not have the track record or the balance sheets to deserve the same trust as the TBTF banks.

ATTN: For everyone with a partner bank, we do not know what happens if these cash management intermediaries goes down. It could take weeks to recover funds, even if the funds are safe.

Are Neobanks Safe to Store Cash?

Neobanks are cash management services or non-traditional banks.

They are safe to use for working capital. However, because they are a fintech layer on traditional banking, if they go out of business, it may take a few days to a few weeks to access your cash.

What happens if Brex goes out of business

Brex co-CEO, Pedro Franceschi, shared:

Brex doesn’t hold funds (it’s a fintech layer), partners hold Brex funds in FDIC-insured accounts or money market funds.

Brex sweeps funds at the end of each day across partner banks. Funds are held in the customer’s name.

Money market sweeps are administered by BNY Mellon into cash or 99.5% T Bills, also in the customer’s name.

If necessary, SIPC and FINRA have access to Brex’s custodial records, along with the partner banks. The remittance of funds should take less than a day.

What happens if Mercury goes out of business

from Mercury CEO Immad Akhund

Someone asked me a great question of how custody and comingling works for funds for@mercury Vault.

This is a fairly technical and detailed answer. Mercury is not a bank or custodian. None of the money touches us, we are a software provider.

System 1: we have two direct partner banks (Evolve and Choice). Under breath the hood they have a sweep network of banks. This is how we deliver up to $3m of FDIC insurance. Your money is held in your name at those banks for both the primary and deep network.

System 2: you can access US govt t-bills via a Vanguard mutual fund. This is held in your name at our custodian (Apex). No comingling is allowed here as you own the actual security.

System 1 and 2 are independent of each other. They are also orchestrated by us but independent from us. Mercury is profitable and growing but even if we disappeared tomorrow your money is at those institutions in your name.

Hope that’s easy to follow. Happy to answer questions on it.

[If we vanish, the underlying partners] have your name, KYC/KYB documents and email address.

There would be an orderly process for sending money to where you need.

Other fintechs have failed before so its not a new process.

Source: Twitter

Brex

I am a Brex customer. They have multiple partner banks and provide up to $1.5M in insured and protected deposits. They had the most information available publicly.

However, Brex default settings only provide $750k in insured and protected deposits, and must be changed. Changing it is easy. I provide a step-by-step guide with images below.

I think they’re the best modern solution, but should be paired with multiple TBTF banks.

Brex is a cash management solution, not a bank. They also provide a credit card and other financial services. Brex accounts are a cash management account (and not a traditional bank account) designed to offer the features of a bank, but with reduced exposure to any bank.

Maximum Safe Deposits: $2.25M FDIC + $500k SIPC

Banking Partners: 10 banking partners

JPMorgan Chase Bank, Axos Bank, East West Bank, Hinsdale Bank & Trust Company, Lake Forest Bank & Trust Company, LendingClub Bank, Merchants Bank of Indiana, Old Plank Trail Community Bank, Town Bank, Wheaton Bank & Trust Company

Brokerage Partner: Brex is its own brokerage provider.

Capitalization: Over $1.5B in fundraising, per Crunchbase

Links of interest

Homepage: https://www.brex.com/

Brex's Money Market Partner: Bank of New York Mellon investing in Dreyfus Government Cash Management Investor Shares (DGVXX)

DGVXX prospectus

$2.25M FDIC coverage announcement

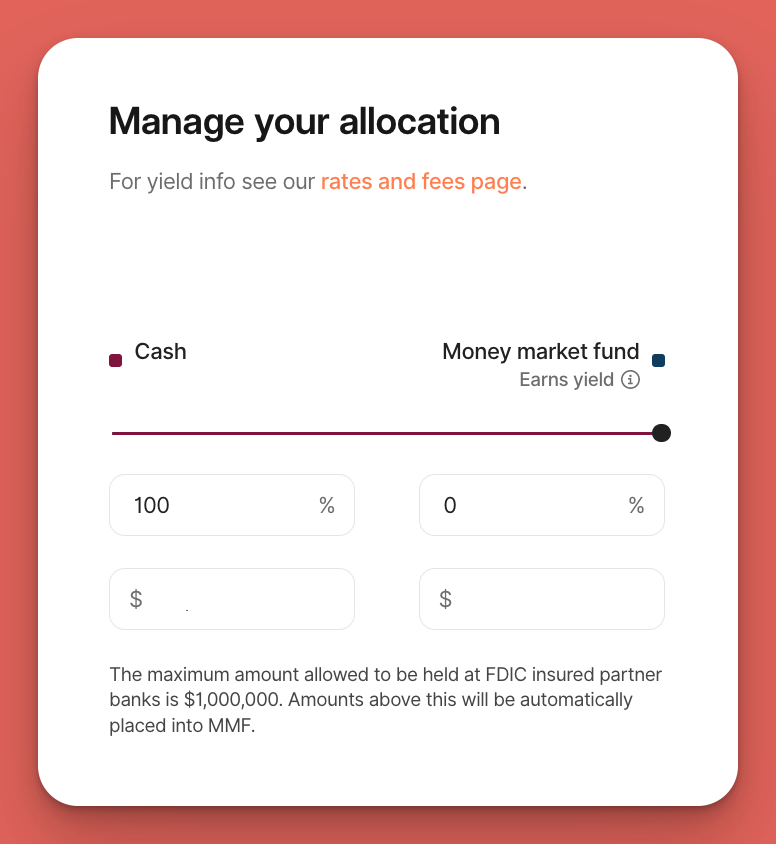

How to change cash allocation in Brex

Log into Brex.

Click “Manage Allocation”.

3. Review your existing allocation. You’re probably on the default allocation of $250k FIDC insured and the rest in the money market account, which is further $500k protected through SIPC, and generates yield.

4. Select “Set custom allocation”.

5. Fiddle with the percentages to choose how much is FDIC-insured versus in a money market account.

The maximum FDIC amount was updated to $2.25M on March 13, 2023.

6. Set your future allocation. After $2.25M in FDIC insured accounts, opt into an addition $500k SIPC protection through the money market account.

7. Review and confirm!

8. Celebrate that you jumped through some hoops to protect your cash!

Mercury

Mercury works with Evolve. Evolve works with high risk fintechs, which may expose it to regulatory risk. Evolve was hacked in June 2024. The Mercury FDIC Sweep program may not cover the full $5M it claims to cover.

Mercury is a cash management solution designed for startups and tech-focused businesses.

Maximum Safe Deposits: $5M FDIC sweep

There are times when not all $1M will be FDIC insured.

Sweep partner Evolve says “has no obligation to place funds into Program Banks to maximize the amount of deposit insurance available on your funds or to maximize the interest rates that your funds may earn. Evolve may place your funds without regard to whether such funds may exceed the Deposit Limit at one or more Program Banks, even if your funds could be placed in one or more Program Banks in an amount less than the Deposit Limit.”

Banking Partners: Choice Financial Group and Evolve Bank & Trust. Evolve has a history of partnerships which may potentially risk their banking license. Evolve was hacked in June 2024.

Brokerage Partner: Apex Clearing

Capitalization: $152M fundraised with $4b in deposits per Fintech Futures

Links of interest

Homepage: https://mercury.com/

Evolve’s page on their Mercury integration

The post says “Any lending our partners do is subject to stress testing, stringent capital requirements, and regulatory oversight.” This is true, but the requirements on these partner banks is not as high as TBTF banks.

Rho

Rho works with Evolve. Evolve works with high risk fintechs, which may expose it to regulatory risk. Interactive Brokers is regarded as very trustworthy. It may be possible to use Rho and avoid Evolve.

Rho is a corporate spend and cash management company. Rho sees SMBs looking for frictionless workflows across banking, cards and accounts payable. The company is laser-focused on automating the back-office and building the platform to enable ‘self driving’ finance in the enterprise.

Maximum Safe Deposits: $250k FDIC + $500k SIPC + $30M excess insurance through Interactive Brokers

Banking Partners: Webster Bank, Interactive Brokers, and Evolve Bank & Trust. Evolve has a history of partnerships which may potentially risk their banking license. Evolve was hacked in June 2024.

Brokerage Partner: Interactive Brokers

Capitalization: $205M fundraised in equity and debt per TechCrunch

Links of interest

Homepage: https://www.rho.co/

Affiliate Discloser: I used Interprime, which Rho acquired and turned into Prime Treasury in March 2022. I have a Rho account open, but it holds no funds.

Arc

Arc works with Evolve. Evolve works with high risk fintechs, which may expose it to regulatory risk.

Arc is cash management solution for software startups. Founded in 2021, Arc is on a mission to help startups grow with high-yield bank accounts and frictionless access to dilution-free growth capital.

Maximum Safe Deposits: $2.75M FDIC insured

Banking Partners: Goldman Sachs, BNY Mellon, and Evolve Bank & Trust. Evolve has a history of partnerships which may potentially risk their banking license. You can request 0 funds at Evolve.

Brokerage Partner: Unknown

Capitalization: $30M fundraised and $150M in debt financing per TechCrunch

Links of interest

Homepage: https://www.arc.tech/

What happened with Silicon Valley Bank?

TL;DR Silicon Valley Bank needed more cash. They did not get it. The bank was shut down by the FDIC. Depositors will receive $250k (FDIC-insured). Other funds are to be decided by the FDIC.

- March 9: News got out, people started pulling funds

- March 9: VCs told founders to pull funds. I know of Y Combinator, Founders Fund, and Coatue.

- March 9: Silicon Valley Bank customer support overwhelmed. Wire transfers are not working. Website and app crashing.

- March 10: The US federal government shuts down Silicon Valley Bank.

- March 10: FDIC announces insured depositors will have access to their deposits no later than Monday morning. Uninsured deposits will receive a dividend and a receivership certificate.

- Silicon Valley Bank was a keystone bank for VCs and founders. Thus, a bunch of money in the venture-startup space just vanished.

- Many startups relied on SVB to pay their employees

There are a number of second order effects:

- Public markets are down.

- Funds are being moved to banks with less exposure to startups.

- SVB competitors have many new deposits.

- Twitter is full of thought-leadership.

I liked the Associated Press’ summary. I also feel that this Axios piece covers the relevant notes.

What happens to my money at Silicon Valley Bank?

On March 12, 2023, the Federal Reserve announced full protection of all depositors involved with SVB/Signature Bank” alongside “additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.”

THE BELOW IS NO LONGER NECESSARY

If you have exposure to the Silicon Valley Bank collapse, take the following steps immediately:

File a FDIC claim

Vol 1 Ventures has created a guide

For exposure over $250,000, or with uninsured deposits, contact the FDIC toll-free at 1-866-799-0959. Leave a voicemail.

Find any proof of assets that you can

Log into SVB portals

Take a screenshot of balances, wires, everything

Include a clock in the screenshot

Further timestamp these screenshots by emailing them to yourself

Identify runway without SVB funds

Account for liquid funds in other accounts

Account for the $250,000 FDIC-insured from SVB

Measure burn, calculate runway

Push off large expenses to increase runway

Explore financing options:

Brex is offering emergency bridge loans to qualified SVB customers to help minimize the impact of recent events on operational spend.

Arc is offering near instant funding approvals to meet short-term working capital needs for startups, including payroll.

More revenue-based financing providers:

Find a new bank

Affiliation disclosure: Shopify Capital customer

Here’s what you can expect to happen next, if you have assets at SVB:

For insured deposits

If you had cash in a FDIC-insured bank account, you will have access to your cash by Monday morning, March 13, 2023. Specifically, up to $250,000 per depositor.

These accounts include checking accounts, savings accounts, money market deposit accounts, certificate of deposits, and cashier’s checks. (source)

For uninsured deposits

For uninsured deposits, or deposits over $250,000, the expectation is that you will get most of your deposits back eventually.

“Most” can mean 50%, and “eventually” can mean years.

It could also be 100% and two weeks. We don’t know.

You will receive a receivership certificate for the remaining amount of their uninsured funds. With this certificate, you will receive distributions of cash. The first distribution (dividend) is expected next week, per the FDIC’s press release.

A secondary market for receivership certificates will pop up.

Thank you to the following for the resources they made that let me educate myself and share this here: